Switch back to German

Extended VAT ID Check

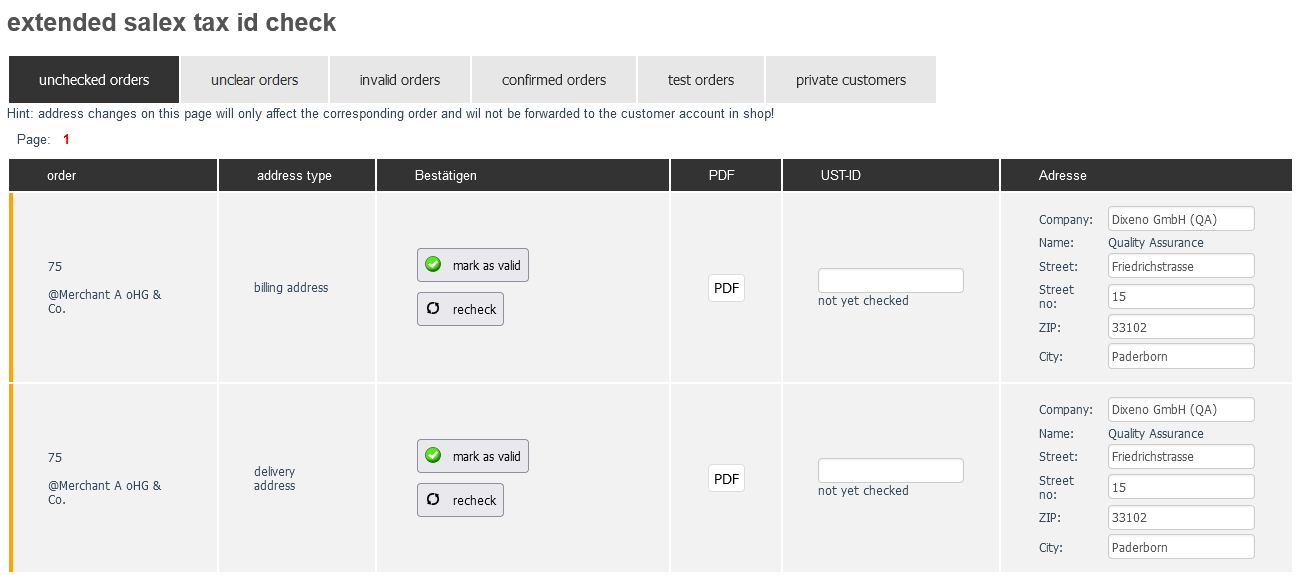

With the extended VAT ID check, you can ensure that customers' "USt-IDs" (VAT IDs) are valid. By default, an OXID store can validate only the correct form of a VAT ID. However, the extended check of the Marketplace module ensures that the VAT ID matches the specified company and customer name. Only then is a VAT ID valid. The test applies to Germany and all countries of the EU.

Both billing and shipping addresses can be checked.

All necessary settings can be found in Marketplace > Sales tax ID check.

| Tab | Description |

|---|---|

| unchecked orders | Lists all orders (including test orders) without a verified VAT ID |

| unclear orders | Lists all orders where VAT ID and specified address do not match |

| invalid orders | Lists all orders where the VAT IDs are invalid |

confirmed orders |

Lists all orders with confirmed VAT IDs Manually confirmed test orders can be found in the test orders tab. |

| test orders | Lists all test orders that have been recognized by the system, e.g., based on the e-mail address |

private customers |

Lists all orders from private persons that were automatically detected by the system because company name or VAT ID are missing Private customers do not need a VAT ID. |

About the "USt-ID" (VAT ID)

The "Umsatzsteuer-Identifikationsnummer (USt-ID)" (VAT identification number (VAT ID)) is a number that companies apply for in addition to their tax number or tax ID. The VAT ID uniquely identifies each company within the European Union (EU). The VAT ID is relevant for invoicing if you conduct B2B business within the EU. This is because the VAT ID can be used to correctly handle sales taxation for transactions between EU countries. Both the invoicing party and the customer must indicate their VAT IDs on the invoice.

According to EU requirements, the VAT ID always contains a two-digit country designation according to ISO (e.g. DE, EN), followed by a maximum of 12 digits, whereby numbers and letters are permitted.

Example:

DE123456789

IE1234567U

Why Marketplace Operators Should Check the ID

If the provision of a VAT ID is required, you as the marketplace operator should validate the VAT ID of the merchants so that the merchants are allowed to trade on the marketplace. Merchants, in turn, are responsible for verifying the VAT ID of their customers. Therefore, it is usually the merchants who perform the extended VAT ID check for customers and not you as the marketplace operator.

However, if you are a merchant on the marketplace yourself, you may need to check the VAT ID of customers. You can learn more about this in the Documentation for Marketplace Merchants. At the same time, you can trigger the check manually if there are any problems or if a merchant contacts you about it.

Check VAT ID and Mark It as Valid

Check VAT ID

How to:

-

Go to Marketplace > Sales tax ID check.

-

In the order, enter the VAT ID in the UST ID field and click the recheck button.

-

To create a PDF file of the check, click the PDF button.

The system assigns the order to confirmed orders, invalid orders, test orders or private customers based on the check results. You will see the result of the check below the USt-ID field, e.g., sales tax id okay, but different address.

Mark VAT ID as Valid

Prerequisites:

- You have checked the data.

How to:

-

In the order, enter the VAT ID in the UST-ID field and the correct company and address data.

-

Click the Mark as valid button.